Email: [email protected]

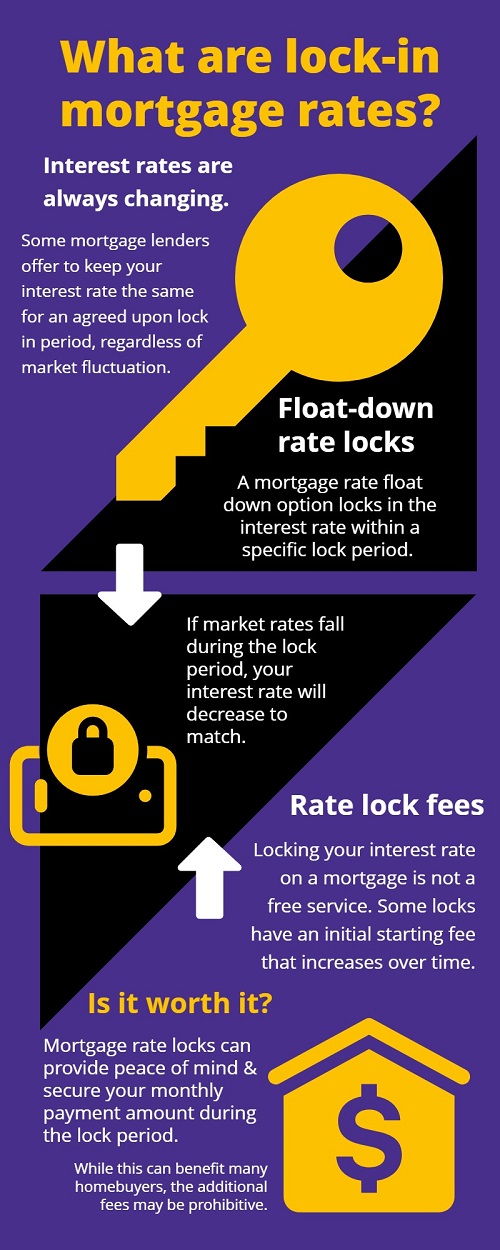

With mortgage rates constantly fluctuating, many lenders offer the ability to lock in a specific mortgage rate. These provisions keep your interest rate the same for an agreed upon lock in period, regardless of whether national rates fall or rise.

However, while a rate lock period can have its advantages, it's not the right answer for everyone. Here is some more important info about mortgage interest rates and locks for homebuyers to be aware of:

If you lock in interest rates on a mortgage loan, you can secure them from the time of approval until five days before closing. However, the lock only lasts until the end of your current loan, meaning your interest rates will no longer be locked if you refinance.

Therefore, timing your mortgage rate lock is crucial - you might even be able to get a lower rate on your second mortgage as well.

A rate lock has far fewer disadvantages than risk. An interest rate lock does not help to get the cheapest mortgages, but rather safeguards your buying power. The rate lock prevents a mortgage's interest rate from increasing and potentially pricing you out of your own home due to high monthly mortgage payments.

Various banks can lock the rates with what are called "float down" provisions. In these cases, the rate is lowered in a specific period after the loan approval. Whenever the price increases, your payment will match what you're quoted for.

While this can benefit many homebuyers, there is a risk that rates will never change in your favor. This would result in paying higher interest rates for the whole term.

Having a rate-lock may reduce your mortgage costs, but the process isn't free of charge. Generally, rate locks include a fee starting an initial amount, which increases over time. In some cases, mortgage lenders will charge a fee for extended locks. Make sure to go over the options carefully to avoid any unpleasant surprises down the road.

Should you accept a lock-in rate from your mortgage lender? Keep these factors in mind to make the best decision for your financial future.

In her role as a real estate and relocation specialist in South Florida and Northern Virginia, Ady Artime prides herself on providing the highest level of service, confidentiality and professionalism to her clients. Based on her own experience as a government liaison, Ady is in familiar territory working with high powered individuals. She possesses a discreet and confidential work ethic, and her keen eye, attention to detail, and experience with multi-million dollar properties have earned her a high-profile, loyal clientele that expect the best from their realtor.

Known for her expertise and strong background in interior design, she stands out from other real estate agents. When a satisfied client says that Ady knows real estate "inside and out", the statement is to be taken literally. Over the course of her career, she has received recognition as an award-winning interior designer. She has designed and implemented interiors for countless luxury projects throughout the United States, and Europe. Her extensive knowledge of all facets of design, including working with architects and construction teams, led to a natural progression into the real estate arena and gives her a definite edge over the competition in serving her clients.

As and agent in South Florida and North Virginia, Ady lends her real estate expertise and design savvy to buyers and sellers. Ady's mission is to develop a faithful, repeat clientele by providing them with superior service and value. She is passionate about her work and takes the time to understand each client's needs and goals to accurately assess the options she provides. From overseeing the staging of a listed property in order to fetch the highest possible price to analyzing a potential purchase from a design and architectural perspective.